Sorry for the title in all caps, but that’s how I feel about this:

ppp| |ppp

|ppp

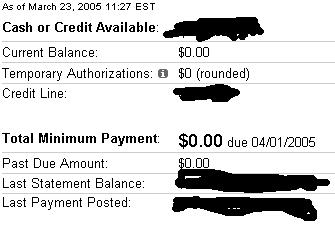

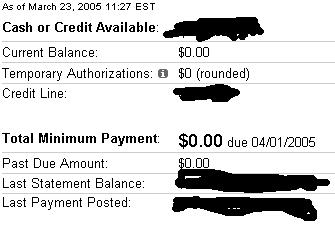

This is the snapshot of our MBNA credit card account, our last remaining high-interest revolving debt. Yep, that’s right… after almost three years of hard work, we’ve finally got that high-interest debt monkey off of our backs.

I was pretty irresponsible with credit during my college years… I had two major credit cards, two store credit cards, and an Apple Loan from MBNA (which I had used to buy my PowerBook, Airport Base Station, and a bunch of other stuff when I realized I could access the credit line using checks). All of my cards and lines of credit were racked up to the max. I would just use them to buy whatever I wanted, without any clear plan on how to pay for everything. I think I realized that I had a problem, but wasn’t willing to deal with it, and I liked all of the stuff that I got with the credit. I just kept paying the minimum payments, and the debt just sat around and accrued interest. It wasn’t until I married Becky that things started to change. Having a financial responsibility to another person was a big wake-up call. With Becky’s help, and some careful planning, we started an aggressive plan for paying off the high interest debt I had accrued. We paid off the highest interest cards first, throwing as much money into the balances every month as we could possibly afford. Becky helped by teaching me to curb my spending habits, taking charge of food and grocery planning, watching for bargains, coupons, and cheap things, and helping enforce a savings plan.

Sure, I do occasionally have those pangs of wanting to go out and buy the latest and greatest gadgets… but I’ve learned that those are pretty irrational, and with some careful planning and budgeting, I have been able to buy some nice stuff without incurring any debt (the new camera, for example). I have also developed a much better ability to be content with what I have. My computers might be 4-5 years old, and they might not be able to run the latest software, but can they do the things I need them to do? Yes, they can.

Now, this doesn’t mean that we’re never going to use our credit card again. A credit card can be useful, as long as it is used responsbily. Don’t carry a balance from month to month. If you do charge something that is more expensive than you can pay within the current billing cycle, pay it off as quickly as possible, and certainly pay more than the minimum payment. Check to see if your card offers any promotional interest rates – for example, if you can get a 0% APR for three months, go ahead and buy that bigger-ticket item, as long as you have a plan to pay it off before the promotional period is over. Otherwise, you are going to be slammed with interest charges.

We do still have a fair amount of student loan debt kicking around. However, the interest rate is pretty low, and we’re on a fixed schedule for paying it off, so it is not as big of a concern. Granted, it is a pretty big chunk of money that we’re paying every month, but the education it helped us attain was well worth it. And of course, now that we’re no longer making huge payments to MBNA, we have the option of sending those funds over into our student loans – or savings accounts or other accounts as desired.

Anyway, this whole thing is really to say a big “Thank You” to Becky, for helping get our spending and debt under control. I don’t know what I’d do without her.

Update

I should mention, by way of full disclosure, that we do still have one debt account other than our student loans… this is the credit account that I got through my dentist when I had to get a root canal. But it is 0% interest for a full year, and we do have a solid plan for paying it off, so this won’t cause any problems for us.

|ppp

|ppp